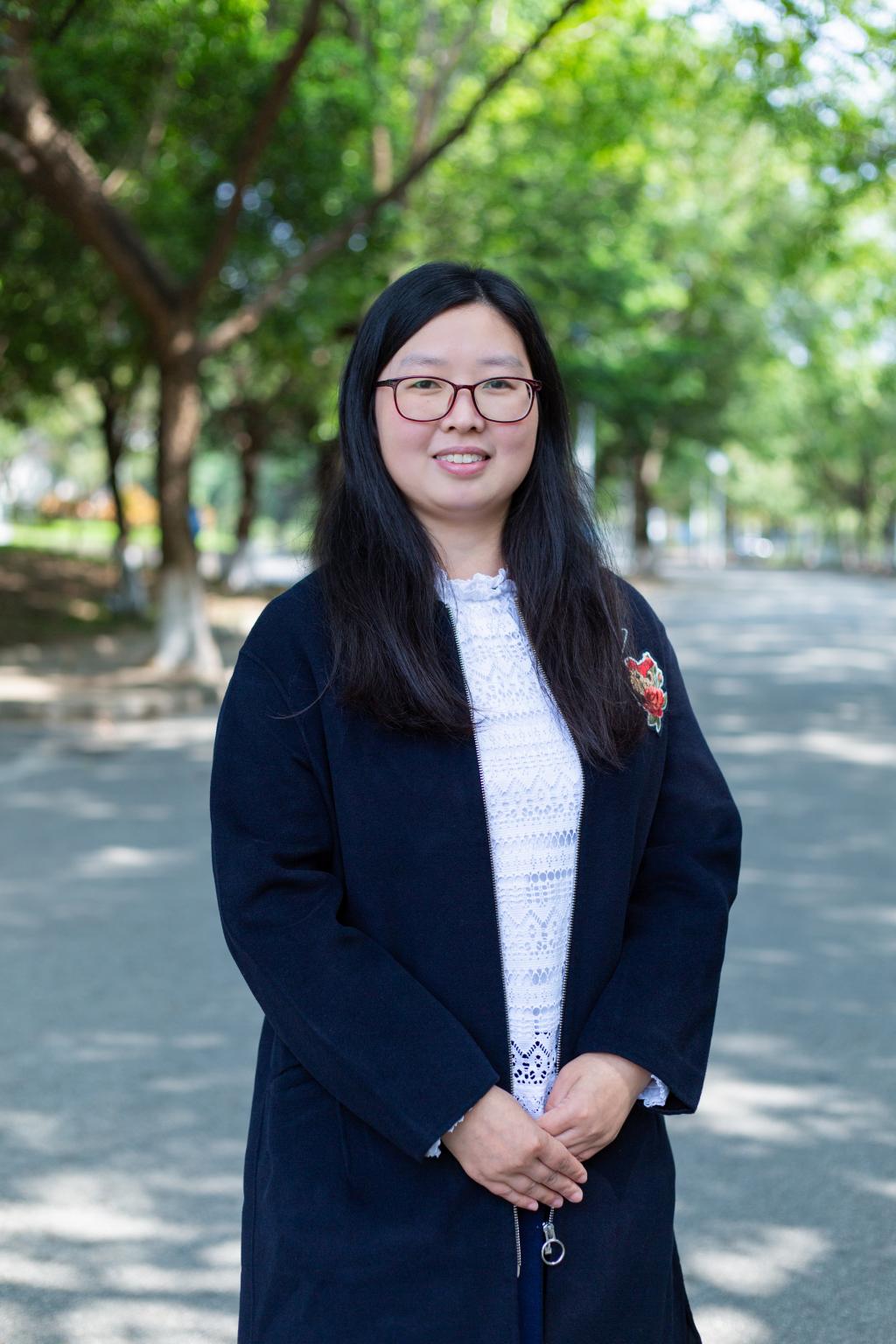

姓名: 王真真

行政职务:

系别:应用数学系

职称:讲师/硕导

办公电话:13763327460

E-mail:wangzhzh@gdufs.edu.cn

一、科研项目:

1. 主持国家自然科学基金青年项目,随机反应扩散方程中的随机行波及其全局分支(No.12101622),2022/01—2024/12,30万元,在研;

2. 主持中央高校青年培育项目,关于随机反应扩散方程行波问题的研究(No.34000-31610285),2020/01至2021/06,已结题;

3. 参与国家社会科学基金项目,企业金融化引致系统性风险的统计监测研究(No.21CTJ014),2022/01—2024/12,20万元,在研;

4. 参与国家自然科学基金,面上项目,几类非线性方程的定性研究(No.11971176),2020/01—2023/12,在研;

5. 参与国家自然科学基金,面上项目,物理中某些耦合可积方程的研究(No.11771151) ,2018/01—2021/12,已结题;

6. 参与国家自然科学基金,青年项目,双噪声扰动下随机Fisher-KPP方程的行波及动力学性质研究(No.11701115),2018/01—2020/12,已结题;

二、科研论文:

[1] Zhenzhen Wang, Hao Dong, Zhehao Huang. Carbon spot prices in equilibrium frameworks associated with climate change. Journal of Industrial and Management Optimization, 2023, 19(2): 961-983.

[2] Yingting Miao, Zhenzhen Wang*. Weak instability of the stochastic generalized Camassa-Holm equation. Communications on Pure undefinedamp; Applied Analysis, 2022, 21(10): 3529-3558.

[3] Shuaishuai Jia, Hao Dong, Zhenzhen Wang*. Identifying the Asymmetric Channel of Crude Oil Risk Pass-Through to Macro Economy: Based on Crude Oil Attributes. Frontiers in Energy Research, 2022, 9, 739653.

[4] Junhao Zhong, Zhenzhen Wang*. Artificial intelligence techniques for financial distress prediction. AIMS Mathemaics, 2022, 7(12): 20891–20908.

[5] Zhenzhen Wang, Tianshou Zhou*. Asymptotic behaviors and stochastic traveling waves in stochastic Fisher-KPP equations. Discrete and Continuous Dynamical Systems-Series B, 2021, 26(9): 5023-5045.

[6] Zhenzhen Wang, Zhenghui Li, Shuanglian Chen*, Zhehao Huang. Explicit investment setting in a Kaldor macroeconmic model with macro shock. Discrete and Continuous Dynamical Systems-Series S, 2020, 13(8): 2327-2346.

[7] Zhehao Huang, Tianpei Jiang, Zhenzhen Wang*. On a multiple credit rating migration model with stochastic interest rate. Mathematical Methods in Applied Sciences, 2020, 43: 7106–7134.

[8] Zhehao Huang, Zhenghui Li, Zhenzhen Wang*. Utility indifference valuation for defaultable corporate bond with credit rating migration. Mathematics, 2020, 8, 2033.

[9] Zhehao Huang, Yingting Miao, Zhenzhen Wang*. Free boundary problem pricing defaultable corporate bonds with multiple credit rating migration risk and stochastic interest rate. AIMS Mathematics, 2020, 5(6): 7746-7775.

[10] Yuhang Zheng, Zhenzhen Wang, Zhehao Huang*, Tianpei Jiang. Comovement between the Chinese Business Cycle and Financial Volatility: Based on a DCC-MIDAS Model. Emerging Markets Finance and Trade, 2020, 56: 1181-1195.

[11] Zhenzhen Wang, Zhengrong Liu, Tianpei Jiang, Zhehao Huang*. Asymptotic traveling wave for a pricing model with multiple credit rating migration risk. Communications in Mathematical Sciences, 2019, 17(7): 1975-2004.

[12] Zhenzhen Wang, Zhehao Huang*, Zhengrong Liu. Stochastic traveling waves of a stochastic Fisher–KPP equation and bifurcations for asymptotic behaviors. Stochastics and Dynamics, 2019, 19(4), 1950028.

[13] Zhenghui Li, Gaoke Liao, Zhenzhen Wang, Zhehao Huang*. Green loan and subsidy for promoting clean production innovation. Journal of Cleaner Production, 2018, 187: 421-431.

[14] Zhenghui Li, Zhenzhen Wang, Zhehao Huang*. Modeling Business Cycle with Financial Shocks Basing on Kaldor-Kalecki Model. Quantitative Finance and Economics, 2017, 1(1): 44-66.

[15] Zhehao Huang*, Zhengrong Liu, Zhenzhen Wang. Stochastic traveling wave solution to a stochastic KPP equation. Journal of Dynamics and Differential Equations, 2016, 28: 389-417.

广东外语外贸大学本科优秀教学奖三等奖(2022年)

《高等数学(1)》、《高等数学(2)》、《寿险精算数学》、《微积分》

学院地址:中国广州市番禺区小谷围广州大学城广东外语外贸大学(南校区)院系楼154

联系电话:020-39326653 020-39326982

电子邮箱:gwstxy@gdufs.edu.cn

Copyright© 2024 GDUFS. All Rights Reserved.